Top 30 Forex Brokers Fundamentals Explained

Top 30 Forex Brokers Fundamentals Explained

Blog Article

Not known Incorrect Statements About Top 30 Forex Brokers

Table of ContentsThe smart Trick of Top 30 Forex Brokers That Nobody is DiscussingThe smart Trick of Top 30 Forex Brokers That Nobody is Talking AboutThe Best Strategy To Use For Top 30 Forex BrokersTop Guidelines Of Top 30 Forex BrokersTop 30 Forex Brokers Things To Know Before You BuyExcitement About Top 30 Forex BrokersThe Facts About Top 30 Forex Brokers Uncovered

It is estimated that there are around 128 pairs that Foreign exchange traders can select to join the currency trading market. FBS. Below are some preferred major money pairs: Australian Dollar/US Buck (AUD/USD. FX is thought about to be the most effective method for beginners to begin their investment occupation and establish their trading skillsA lot of Forex systems supply complimentary demonstration accounts allowing newbies to obtain a taste of market movement and establish a reliable FX trading strategy. The reduced resources barriers, as well as no compensations on a lot of accounts, are a few of the reasons that Forex markets are picked by most enthusiast in trading

Little Known Facts About Top 30 Forex Brokers.

A tiny investment can bring about high revenue. A newbie can get in a funding of $500 and trade with a margin of 1:500. This can result in excellent money revenues, however also might work conversely with high possible danger and losses. Foreign Exchange has tiny or no trade payments in a trading account.

Therefore, there is constantly a prospective retailer waiting to get or offer making Foreign exchange a liquid market. Cost volatility is among one of the most crucial variables that assist make a decision on the following trading relocation. For short-term Forex investors, price volatility is vital, given that it shows the hourly modifications in a possession's value.

10 Easy Facts About Top 30 Forex Brokers Explained

For long-lasting capitalists when they trade Foreign exchange, the price volatility of the market is additionally fundamental. This is why they take into consideration a "acquire and hold" method may offer higher earnings after a long period. Another substantial advantage of Foreign exchange is hedging that can be applied to your trading account. This is a reliable technique that helps either eliminate or reduce their danger of losses.

The four major directional trading sessions are split as followed: The Sydney Session; The Tokyo Session; The London Session; The New York Session. In the 24-hour Forex market, investors can start their account relocates when the Sydney Session opens up till the close of the New York Session. Specialists that trade Forex split their trading right into my company 4 sessions depending on the geographical location: Pacific Session (Sydney Session); The Eastern Session (Tokyo Session); The European Session (London Session); The North American Session (New York Session).

The 10-Minute Rule for Top 30 Forex Brokers

Depending on the moment and effort, traders can be divided right into groups according to their trading design. A few of them are the following: Forex trading can be efficiently used in any one of the methods above. Additionally, because of the Foreign exchange market's great quantity and its high liquidity, it's possible to get in or leave the market any time.

Its decentralized nature demands continual connectivity and adaptability. This is why a variety of developers are frequently working to boost this modern technology, making Forex trading systems better for modern financing demands. Thus, technical advancements aid Foreign exchange trading to come to be a lot more prevalent because every person can trade from anywhere in the world.

The Ultimate Guide To Top 30 Forex Brokers

Hence, it's feasible to start with any trade dimension. There are three types: Micro Whole lot. This kind equals 1,000 units of currency. Mini Great deal. This equals 10,000 units of money. Standard Lot. This is the largest whole lot and amounts to 100,000 units of money. The mini great deal is frequently made use of by newbies and aids them have more efficient threat monitoring.

Foreign exchange trading is a decentralized technology that operates with no central monitoring. XM. A foreign Forex broker need to conform with the standards that are defined by the Foreign exchange regulator.

Professionals and novices safeguard their funds by transferring them in various other accounts different from the brokers, so the latter can not use foreign money for their own service. In the checklist below, you will discover a few of the most prominent FX regulatory authorities: Australian Stocks and Financial Investment Compensation (ASIC); Financial Conduct Authority (FCA); Assets and Futures Trading Payment (CFTC); Stocks and Exchange Board of India (SEBI).

The Greatest Guide To Top 30 Forex Brokers

Thus, all the transactions can be made from anywhere, and considering that it is open 24 hr a day, it can also be done any time of the day. As an example, if a financier lies in Europe, he can trade throughout North America hours and monitor the steps of the one money he has an interest in.

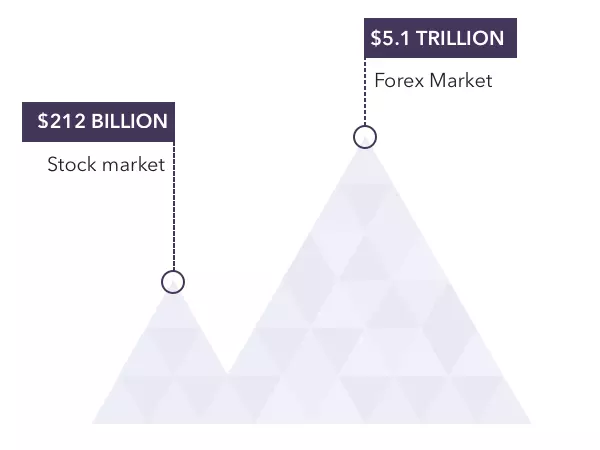

In contrast with the stocks, Foreign exchange has very reduced transaction costs. This is due to the fact that brokers make their returns through "Things in Portion" (pip). Most Forex brokers can provide a really reduced spread and decrease or even remove the investor's prices. Investors that pick the Foreign exchange market can boost their earnings by avoiding costs from exchanges, down payments, and other trading tasks which have additional retail purchase costs in the securities market.

Top 30 Forex Brokers Fundamentals Explained

Report this page